Retirement should bring peace, not financial stress. For senior citizens who own a house but lack regular income, SBI’s Reverse Mortgage Loan offers a dignified way to turn their property into a reliable income stream, without selling it or leaving their home.

What is a Reverse Mortgage?

A reverse mortgage allows homeowners aged 60 and above to mortgage their self-occupied residential property to a lender, like SBI, in exchange for regular payments. Unlike traditional loans, there’s no obligation to repay during the borrower’s lifetime. The loan is settled upon the borrower’s demise or if they permanently move out, typically through the sale of the property.

Key Features of SBI’s Reverse Mortgage Loan

This section explains the core features of the SBI Reverse Mortgage scheme, from eligibility to payout options.

- Eligibility: Indian citizens aged 60 and above (spouse can be 55+ in case of a joint loan). Must be the owner and occupant of the property.

- Property Criteria: The house must be self-occupied, self-acquired, and free from legal issues or liabilities. It should be located within municipal/corporation limits.

- Loan Amount: Ranges between Rs 3 lakh and Rs 1 crore, depending on the market value of the property and the borrower’s age.

- Loan Tenure: Typically 10 to 15 years (can go up to 20 years in certain cases).

- Disbursement Options: Payments can be received monthly, quarterly, half-yearly, or annually, based on the borrower’s preference.

- Ownership Retained: You continue to live in and legally own the property throughout your lifetime.

- Repayment: No repayment during your lifetime. After death or permanent move-out, the bank recovers the amount by selling the property.

Major Benefits of Opting for SBI’s Reverse Mortgage

A reverse mortgage offers more than just money — it provides security, dignity, and flexibility for seniors in their golden years.

- Stable Monthly Income: Helps manage daily expenses, medical bills, or leisure needs without depending on children or selling the house.

- Live with Dignity: You don’t need to leave your home or worry about EMIs. You receive money, but retain full rights to stay.

- Flexible Usage: Funds can be used for anything, unlike traditional loans that have spending restrictions.

- No Monthly Repayments: Since repayment happens only after death or permanent move-out, there is zero financial pressure during your lifetime.

- Tax-Free Payments: The regular payments are treated as loan disbursement and are not taxable as income.

Considerations Before Applying For a Reverse Mortgage Loan

Though a reverse mortgage is a powerful tool, it’s important to understand its implications, especially for heirs and estate planning.

- Reduced Inheritance: Since the bank sells the property to recover the loan, your heirs may not receive the full property value. However, they can repay the loan and reclaim the house.

- Interest Accumulation: Interest compounds over the years and adds to the total loan amount, which can reduce the remaining equity in the house.

- Limited Loan Amount: Only a percentage of the property’s market value is given as a loan (usually 55–60%). You don’t get the full value as cash.

What Happens to the Excess Property Value?

Let’s say your home is worth Rs 50 lakh, but SBI gives you Rs 30 lakh through the reverse mortgage. What happens to the remaining Rs 20 lakh?

Here’s how it works:

- Loan Settlement: After the borrower’s death or vacating the house, the bank sells the property.

- Recovery: The bank recovers the total loan amount plus accumulated interest.

- Excess Amount: Any remaining amount (after repaying the loan and interest) is returned to the legal heirs of the borrower.

Real-Life Example: Reverse Mortgage Loan Calculation

If the home is sold for Rs 55 lakh and the outstanding loan with interest is ₹35 lakh, the remaining Rs 20 lakh goes to the heirs.

Here’s a simplified example to help you understand what you might receive through SBI’s Reverse Mortgage.

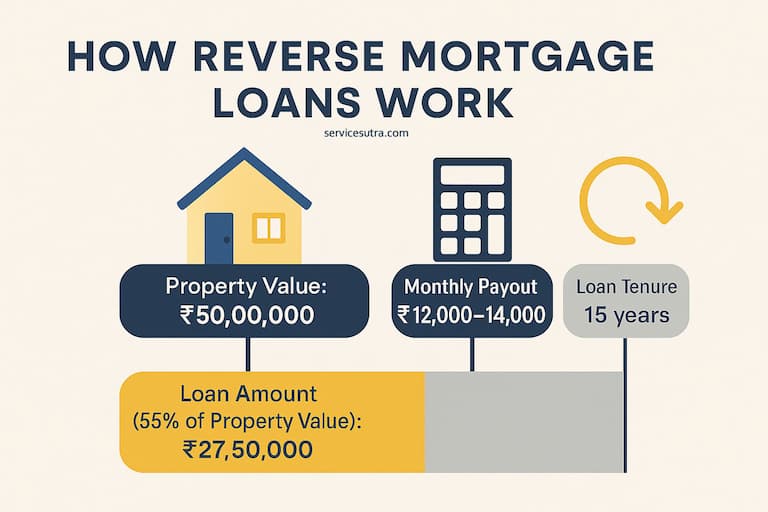

Property Value: Rs 50,00,000

- Approx. 55% of property value eligible for loan = ₹27,50,000

- Loan tenure: 15 years

- Estimated SBI interest rate: 8.50% (compounded annually)

- Monthly payout option selected

Estimated Monthly Payout: Rs₹12,000–Rs 14,000

This payout may vary based on:

- Your age (older borrowers receive higher payouts)

- Property location and condition

- Chosen tenure

- Current interest rate

Please note that this is an approximate illustration. Actual payouts are determined at the time of loan approval based on multiple factors.

How to Apply for SBI’s Reverse Mortgage Loan

Interested applicants can visit the SBI Reverse Mortgage Loan page for detailed information and application procedures.

Final Thoughts

SBI’s Reverse Mortgage Loan is a thoughtful financial product that allows senior citizens to make the most of their lifelong asset — their home — without giving up the comfort or control they’ve earned.

- Perfect for retirees with limited income

- Ensures financial independence

- Offers peace of mind and stability